According to the latest statistics on DeFi Llama, as of May 6, 2022, the total value of locked (TVL) in DeFi is 1960.84 billion dollars. So every time you mention DeFi, you’ve heard of the term Total Value Locked (TVL), but what does this term mean, and what importance does it have for DeFi? To be able to answer the question “What is Total Value Locked” let’s go ahead with us!

What is Total Value Locked (TVL)?

Total Value Locked (TVL), aka Total Value Locked. This is the total value of assets locked in the DeFi smart contract. This number corresponds to the number of assets sent in a given protocol. In addition, TVL represents the total assets deposited into decentralized finance (DeFi) protocols to receive rewards, interest, tokens, etc.

“Some investors often use the TVL index to evaluate when comparing DeFi dApps, a dApp with a higher TVL index indicates that the dApp is good.” However, the above argument may not be correct because to evaluate any potential dApp, many factors need to be considered, such as circulating supply, maximum supply, the token price at present, etc. make the correct decision.

Total value Locked (TVL) uses three main units, USD (US Dollar), ETH (Ethereum), Bitcoin (BTC). In addition, DAI is also used as a unit of measurement for TVL, but this unit is not used very often.

Formula to calculate TVL

To calculate TVL you need three basic metrics: Current Market Cap, Circulating Supply, and Current Price.

Total Market Cap = Circulating Supply * Current Price Total Value Locked (TVL) = Total Token Locked * Current Price TVL Ratio = Total Market Cap / TVL

Why is TVL important?

Some of the top DeFi projects by TVL

TVL is the clearest indicator of a DeFi project’s popularity among active users. It is a good metric for assessing project solidity.

Market capitalization metrics can indicate the protocol’s appreciation for the entire market, including passive investors. These passive users are cryptocurrency traders who invest in the protocol’s tokens with the expectation that the project grows and succeeds. They may not necessarily use the protocol itself in any working way.

By purchasing the platform’s token in the hope that its price will rise, these users contribute to the increase in the number of TVLs. Using an analogy with traditional finance, these market players can be seen as the “shareholders” of the protocol.

TVL metrics, on the other hand, reflect platform usage by active players who trade using the platform. As a result, TVL is an important surrogate metric for market capitalization.

If you need a measure of what the market thinks about the future potential of the Defi project, take a look at the market capitalization metric. If you need to see what the market thinks about the project, study the TVL metrics.

Also, it’s helpful to look at the TVL ratio, a combined measure of market capitalization and TVL statistics. The TVL ratio is calculated by dividing the protocol’s market capitalization by its TVL. The smaller value of the TVL up rate takes precedence. It points to a protocol that is potentially undervalued and, therefore, may have good potential for growth in the future.

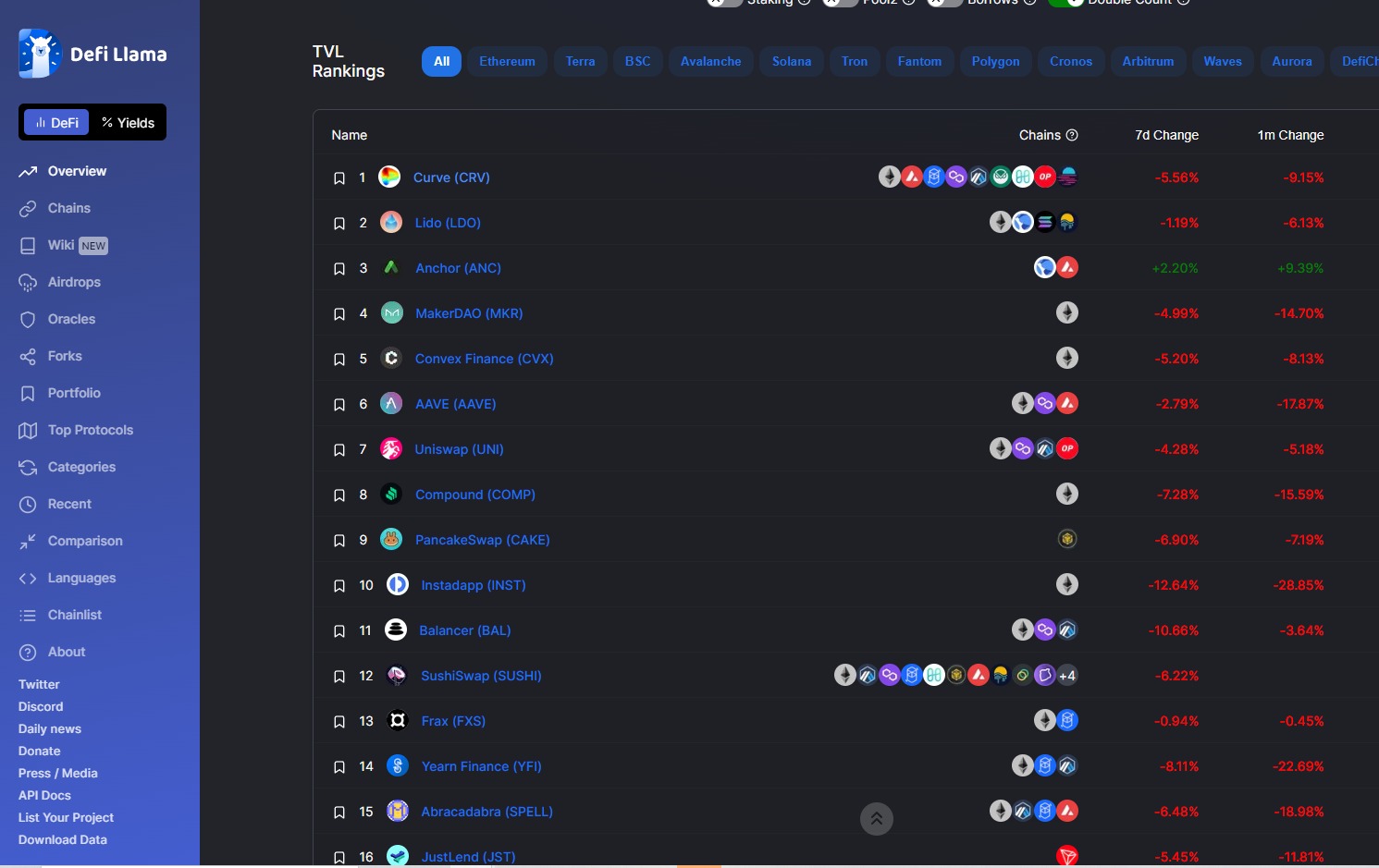

According to DeFi Llama statistics at the time of writing, the top DeFi project based on TVL is Curve (CRV), with a total TVL value of $18.68 billion.

Categories using TVL

TVL metrics are tracked by users in the following DeFi protocols:

- Lending

- DEX

- Derivatives

- Synthetic Assets

- Payment Protocol

In addition to calculating TVL on DeFi, people can also calculate TVL value on the Proof of Stake blockchain. The TVL value on the Proof of Stake blockchain will reflect the security level of the blockchain network’s information. Or, in the extremely important case of Ethereum, users can stake and authorize ETH for validators to participate in the conversion to Ethereum 2.0.

Misunderstandings need to be cleared up.

Although many people have the act of comparing the TVL of protocols for ranking. However, this approach will not work in some respects.

As Sam Bankman-Fried, chief executive officer of FTX concluded:

“TVL is a pretty meaningless metric in the case of:

You can pay for TVL temporarily by airdrop;

When there is more capital thanks to yield farming, the more farm there are. But yield farming does not support the price.”

The second thought is called the sum of the locked values. But not in all cases, this property is “locked”. They may be “kept safe” in the smart contracts of the DeFi application.

Some websites provide TVL in DeFi.

Defi Pulse

DeFi Llama

Summary

Total Value Locked (TVL) is an important parameter that reflects investor engagement and interest in projects in DeFi. As for investors, this data will help investors make assessments about the liquidity and future potential of that project, thereby helping investors to make informed decisions. Make the right decisions easily. At the same time, the value of TVL can also reflect the supply and demand of a token in the crypto market. Hopefully, through this article, people can understand more about the term What is Total Value Locked (TVL)? Note that before deciding to participate in a project, do not only rely on the value of TVL, but everyone should combine many other factors to make the best decision.

Join our community to catch the latest trends, update diverse ecosystems and potential projects to equip more knowledge in the Crypto market!

Disclaimer: This article is for informational purposes only and should not be considered investment advice. Crypto investment is a form of risky investment and participants are fully responsible for their investment.