Tokenomics is the key to success for many Cryptocurrency investors. However, many people are not very interested in tokenomics. This is a wrong thought. Therefore, to master the game, investors need to understand what is tokenomics of each project.

So, What is Tokennomics in Crypto Market?

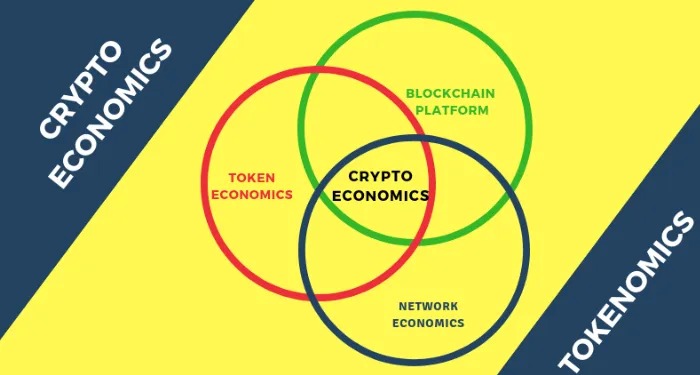

Tokenomics is a combination of tokens and economics, expressing the nature of the economic model of Crypto assets in the Blockchain world.

Tokenomics describes the factors that affect a token’s use and value, including its creation, distribution, incentive mechanism, token burn scheme, and supply and demand.

For crypto projects, optimally designed Tokenomics is an important factor for the success of that project. Therefore, Tokenomics plays an extremely important role when it comes to financial investments.

Why Investors Need to Know About What is Tokenomics

Reasons why investors need to care about Tokenomics:

- Tokenomics provides an understanding of the short-term performance of the cryptocurrency market.

- Tokenomics helps determine the future value of assets.

- Tokenomics provides insight into the future return of one crypto asset versus another.

Besides, investors need to firmly grasp the following 3 main factors to read the Tokenomics position of any cryptocurrency project:

- Learn how to use digital currency and a direct connection between services is being built.

- Find out the total number of tokens available, their future stock limits, and when they will be created.

- Know the owners of the digital coins and whether the coins are reserved for future release to developers.

Why Is Tokenomics Important When Investing in Cryptocurrencies?

Tokens are assets that are mainly traded on the exchange. With each certain project, there will be the following users participating in the market: developers, market makers, large investment funds, and individual investors…

So, who will be the master of this “game of chess”? That is Market Maker, developers, and large investment funds. The token is something that you buy and sell and put your trust in it. But tokens are something built by great developers, builders, and market makers. In short, the crypto market is a zero-sum game, everyone wants to make money, so who will lose?

Tokenomics will be the explanation of how this works. And you must master it to be able to profit from the market.

Factors affecting electronic tokens

1. Token distribution and allocation

One of the key factors that determine the value of a crypto token is how that token is distributed.

Systems that reward validators or miners with coins through the Airdrop. Some other investors sell a portion of the token source to potential users in an initial coin offering (ICO – Initial Coin Offering for short).

Besides, if the project is distributing tokens to more and more participants, investors may assume that this is a legitimate project and are really interested in further development.

So if you want to make sure that the project you are investing in is legitimate and ambitious, make sure it distributes tokens to potential users.

2. Token Supply

A key component of Tokenomics is supplied. There are currently three main types of supply that you need to check when it comes to cryptocurrencies:

- Total Token Supply: Indicates the number of tokens in existence at the present time but does not include the number of tokens that have been burned.

- Token Circulating Supply: This shows the number of tokens that have been issued to date and are currently in circulation.

- Maximum Token Supply: Provides information about the maximum number of tokens that can be created. For some tokens that do not have a maximum supply, many tokens will be issued.

3. Market Cap

Market Cap or Market Capitalization helps investors see the full amount of money that has been invested in the project so far.

In addition to the market capitalization, you can also check the fully diluted market capitalization of a project, which is the market capitalization if the maximum supply of the Token has been fully circulated.

Formula to calculate token capitalization types:

- Market Cap = Number of Tokens in Circulation x Current Token Value

- Total Token Supply = Maximum Token Supply – Number of Tokens Burned

- Diluted Market Cap = Total Token Supply After Burn x Current Token Value

4. Model of Token

The Token model helps you to know if the Token model is inflationary or deflationary. Tokens do not have a maximum supply and will continue to be produced over time like Token SLP – Smooth Love Potion.

The token model is deflationary, when there is a maximum supply of tokens, for example, Bitcoin has a maximum of 21 million units.

What is Tokenomics Use Cases?

1. Staking

Staking is one of the topics of particular interest to investors.

Staking is the process of locking tokens for a specific period of time (depending on the cryptocurrency) in order to receive passive income or rewards from the network. However, staking has a disadvantage in that it is not possible to move the staked tokens until the staking period ends.

If a large number of tokens are staked, then the supply will be more limited during the staking period. This can affect the price of the cryptocurrency.

There are some cryptocurrencies with lower staking times or no staking times at all. As a result, major price increases or decreases may not occur as users can easily buy or sell tokens.

2. Value exchange

The most common examples of tokenomics use cases also refer to their use to exchange value. Bitcoin is a prime example of tokenomics use cases for value.

In addition, developers can leverage tokenomics to incentivize fundraising activities as well as to launch decentralized applications.

3. Contribute to the project

In 2021, the majority of tokenomics is used to incentivize investors as well as users to participate in the project.

4. Liquidity Mining (Farming)

For DeFi tokens, there have been many recent appearances. Users can use them to provide liquidity for DeFi protocols, in return they will be rewarded with the project’s native token.

5. Network fee

To make a transaction, users need to pay a fee to the network, more specifically the Validators for them to confirm the transaction for them. Each blockchain network will have its own native token used to pay for the network (usually projects operating in the field of blockchain platform). For example:

- Ethereum uses ETH.

- Binance Smart Chain uses BNB.

- Solana uses SOL.

- Polygon uses MATIC.

Conclusion

Tokenomics plays an important role in the operation of a blockchain or dapp. Therefore, to win the crypto market, investors need to equip themselves with all knowledge of tokenomics. From there, it is possible to analyze and select the best crypto projects.