Funding Rate is a very familiar term in Margin and Futures transactions. Funding Rate is just a fee to be paid between the parties to the contract and is not related to the exchange.

What is Funding Rate? Why should traders care about it?

Some information to know about Funding Rate

What is Funding Rate in details?

Funding Rate is a term commonly seen on exchanges that support Margin, Futures trading. This is a fee that borrowers have to pay periodically to lenders on exchanges.

Usually, Funding Rate on exchanges will be calculated according to different time frames. For Binance, the Funding Rate will be calculated every 8 hours on the time frames of 7:00, 15:00 and 23:00.

Some information to know about Funding Rate

How to Calculate Funding Rate & Funding Fee

The Funding rate is calculated based on the interest rate (Interest rate) and the price difference between the perpetual futures contract and the spot market (Premium). Funding Rate is usually calculated automatically by cryptocurrency exchanges.

When the Funding Rate is positive, that is, when the price of the Perpetual Futures Contract is higher than the price in the spot market (Spot), the person opening a Long order will have to pay the person opening a Short order and vice versa. again. This is to keep the price of the perpetual futures contract at or close to the spot market price.

Funding Fee is another concept in perpetual futures contract trading. The calculation formula is as follows:

Funding Fee = Volume of trading order x Funding Rate.

Example: Investor has 10 USD and decides to open a Short order with 10x leverage, the total volume is 100 USD. Assuming, Funding Rate is 0.0004%, then the investor will have to pay a Funding Fee of 100 * 0.0004% = $0.0004. That is, investors will receive $0.0004 from the person who opened a Long order.

The importance and effects of Funding Rate for traders

Why Funding Rate?

With a traditional futures contract, payments will be made on a monthly or quarterly basis, depending on the conditions of each contract. At settlement, the price of the futures contract will be based on the spot market price and the expiration of open positions.

With perpetual futures, open positions will not have an expiration date like in a traditional futures contract. That is, traders can hold a Short/Long position forever unless the order is liquidated. Therefore, perpetual futures trading is also similar to Spot trading.

In addition, investors’ expectations in the future are often different from the reality of the spot market, leading to a large price difference between these two markets.

Therefore, Funding Rate was created to balance the prices in the two markets as well as optimize the benefits of investors.

How does Funding Rate affect traders?

Funding rate will directly affect the profit or loss of each trader. The higher the leverage, the higher the Funding Rate traders have to pay.

In addition, the Funding Rate is calculated on a cyclical basis (8 hours / 1 time), so traders may pay this fee many times in 1 day. Conversely, as a beneficiary of Funding Rate, investors will also earn a certain amount of profit.

As such, traders need to develop a suitable trading strategy to take advantage of the Funding Rate and minimize the risk of holding trades for too long.

Funding Rate and Market Sentiment

In addition to the direct impact on traders’ profits, the Funding Rate reflects the psychology of investors in the cryptocurrency market. Therefore, investors can consider Funding Rate as a reference indicator and predict the trend of the cryptocurrency market in the near future.

Specifically, when the Funding Rate is positive, it shows that investors in the market are in an excited state. On the contrary, when the Funding Rate begins to turn negative, most investors think that the market will likely reverse its uptrend to a downtrend.

When the Funding Rate is too high, the market may have a correction to rebalance this index. Therefore, monitoring the Funding Rate is also extremely important for taking profit and stopping loss on Margin and Futures trading orders.

Compare Funding Rates on Exchanges

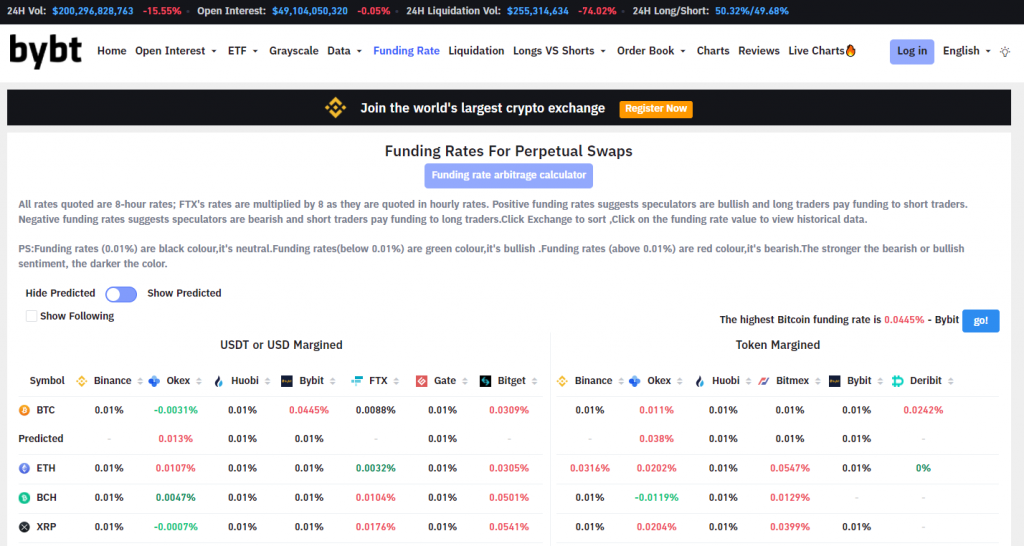

Funding Rate on exchanges usually fluctuates at 0.015%. This number will vary between exchanges because it is adjusted by the difference in prices of digital assets, interest rates, etc., according to the regulations of each exchange.

However, with some exchanges making it easier for investors to trade perpetual futures contracts, they will have their own mechanism to keep the Funding Rate low and stable, except in the case of the market. strong volatility (Flash Dump or Pump).

Some Funding Rate Tracking Apps

Investors can monitor Funding Rate right on exchanges such as FTX, Binance, OKEx… In addition, investors can also track this index on data aggregation and market analysis websites such as Bybt , Coinalyze…

Funding Rate view interface on Bybt

Conclusion

Thus, I have just provided you with all information about what is Funding Rate as well as its calculation and impact on traders. The Funding Rate plays an important role in keeping the price of the perpetual contract at or near the same as the spot market price. At the same time, Funding Rate also helps traders understand the psychology of other investors in the cryptocurrency market.